Love your bank

Welcome to the future of banking — manage your money and grow your savings in one beautifully simple app that's trusted by millions.

This is how I bank

What’s your unique way of banking? Whether here, there — or even in your underwear — N26 makes banking stress-free, so you can manage your money exactly how you want.

The free bank account that makes life easy

Not a fan of waiting times, hidden fees, or paperwork? Us too. Get a bank account with a virtual card and 24/7 support — and manage your money on the go.

Open N26 Standard Account

Security is a top priority at N26

N26 operates with a full German banking license, and your bank account with a German IBAN is protected up to €100,000, according to EU directives. And with fingerprint identification and advanced 3D Secure technology, you can rest assured you’re extra safe when making purchases in stores and online.

Learn more about Security at N26N26 Smart—save and spend with confidence

Discover N26 Smart, the bank account that gives you more control over your money—with a direct customer support hotline if you ever need help. Choose a Mastercard in your choice of 5 colors and organize your finances with 10 Spaces sub-accounts—including Shared Spaces to save together with others. Plus, get an overview of your spending with Insights, and learn to budget better along the way.

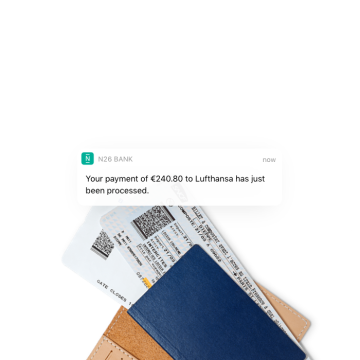

Stay tuned with push-notifications

Keep track of every transaction that comes in and out of your bank account, thanks to real-time push notifications. Whether you’re withdrawing or depositing money, making a transfer or completing a monthly standing order—you’re always kept up-to-date.

Get Insights into your spending habits

Not sure where all your money's going? Our Insights feature automatically categorizes your spending in real time. Track regular expenses, keep a pulse on your costs, and spot opportunities for savings. Everyday budgeting has never been easier.

Learn about budgeting

N26 Crypto — so easy to use

Say hello to N26 Crypto! So easy to try — it’s just a few taps away from your cash in the N26 app. And, you’ll get instant trades, clear insights, and access to almost 200 coins.

Take a lookThe market for crypto assets constitutes a high risk. Crypto assets are subject to high fluctuations in value, and there is no real underlying asset. A complete loss of the money spent is possible at any time. N26 Crypto is powered by Bitpanda Asset Management GmbH.

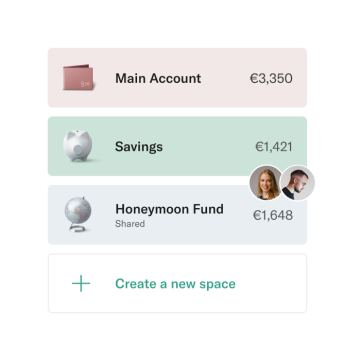

Reach your goals with N26 Spaces

Give your financial goals room to grow with N26 Spaces sub-accounts. Personalize each space with a name, set your savings target, and easily stash savings aside with just a few taps.

Rather set it and forget it? Easy—create Rules to regularly move money over to a space, or try Round-Ups to save up the spare change whenever you pay by card.

Manage your money with Spaces

Make payments the easy way with Apple Pay

Tired of carrying your wallet around? We get it—which is why you can link your N26 Mastercard to Apple Pay for effortless payments right from your smartphone. Apple Pay lets you make secure, contactless payments online, in stores, or even in-app. Each transaction is verified by touch or face ID, and takes place in real-time. It’s the simple, safe, 100% mobile way to pay.

Try Apple PayN26 Support is here for you — in several languages.

If you have any questions or run into any problems, our N26 Customer Support team is always on hand to help you in English, French, German, Spanish and Italian. Just reach out to them via email or chat to an N26 expert right in your app.

Noteworthy reads

Articles and stories to help you make the most of your money

N26 celebrates 7 million customers

Thank you to all 7 million N26 customers across 25 markets who have trusted us to put their financial interests first.

CEO Blog: Grooming the next generation of global entrepreneurs

At N26, we pride ourselves on encouraging innovation, disruption and an entrepreneurial spirit as almost a school for entrepreneurs.

*The interest rates are based on your N26 membership: 2.8% for Standard, Smart, and You, and 4% for Metal.