TymeBank (Take Your Money Everywhere), founded in 2017, is South Africa’s largest digital bank with a customer base of 7.5 million. TymeBank provides a wide range of banking products and services, including transactional accounts, savings accounts, loans, and insurance. TymeBank has gained significant popularity among middle-income and low-income South Africans because of low-cost fees and convenient mobile app.

Who is the owner of Tyme Bank?: African Rainbow Capital Financial Services Holdings, which is owned by South African entrepreneur Patrice Motsepe, has a 90% majority stake in the bank. By March 2021, Tyme bank customers reached 3 million.

Benefits of TymeBank

TymeBank gives its customers many benefits, including:

- Fast and easy. Opening an account is fast and easy. The only information needed is an ID number, residential address and a South African mobile phone number. You can get TymeBank card (Visa debit card) instantly at TymeBank kiosks.

- Affordable. The bank has no monthly fees and offers free or very low charges for banking transactions.

- Rewards. Account holders earn bonus TymeBank Smart Shopper points wherever they shop, and double Smart Shopper points when they swipe and pay inside Pick n Pay.

- TymeBank Savings Account. You can save money by using its GoalSave feature.

Disadvantages of TymeBank

TymeBank has several disadvantages. Some of them are:

- GoalSave withdrawal. If you want to withdraw your money from your GoalSave account, you have to withdraw the whole amount.

- TymeBank kiosks. You can only withdraw money from Pick n Pay, TFG (Foschini stores), and Boxer stores unless you use your Visa debit card.

- Limited transactions. If you open your account online, your transactions will be limited until you go to TymeBank kiosk and upgrade your account to a full account after your biometric data is captured.

- Visa card limitation. With TymeBank Visa card, you can only pay for goods and services at companies in South Africa.

- Geographic limitation. Only South Africans can open bank accounts.

How TymeBank Bank Works

Being a virtual bank in South Africa, TymeBank does not have any physical location. You can deal with the bank using TymeBank app, TymeBank website or TymeBank kiosks at South Africa’s major retail store Pick n Pay, TFG stores and Boxer stores. There are over 500 kiosks around the country. Account holders can pay for goods and services online at over 80 merchants in South Africa.

How to Open TymeBank Account

It takes less than 5 minutes to create Tymebank your account. What is needed to open a TymeBank account is your South African ID number, residential address, your thumbprint and an active South African cellphone number. The bank verifies your identity by asking you several questions, and then you will be given a One-Time PIN (OTP). You are allowed to open TymeBank personal account or TymeBank business account.

There are three ways to open Tymebank account.

- You can open Tymebank account online in South Africa on Tyme Bank website.

- You can create Tymebank account at TymeBank kiosks located at Pick n Pay, TFG stores and Boxer stores. If you open your account at a Tyme Bank kiosk, your biometric data will be captured and a free Visa debit card will be issued instantly. Moreover, when you open your account at Pick n Pay, you can automatically join their Smart Shopper programme.

- You can also open via TymeBank app for Android and iOS.

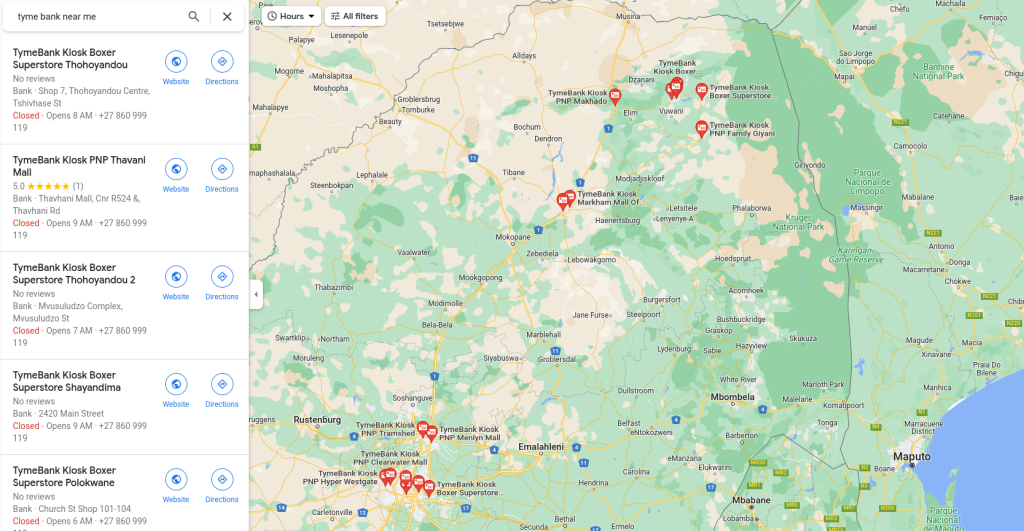

Tyme Bank Near Me

TymeBank Products

Apart from the normal personal account called EveryDay bank account, the bank offers the following features:

TymeBank EveryDay Account

The TymeBank Everyday Account is a free transactional account that offers a variety of features, including no monthly fees, free ATM withdrawals, a free Visa debit card, instant money transfers, and 24/7 customer support. However, the account has a low interest rate, no overdraft facility, and a limited ATM network.

If you are looking for an account with a higher interest rate or an overdraft facility, you may want to consider a different account. However, if you are looking for a free, convenient, and easy-to-use transactional account, the TymeBank Everyday Account is a good option.

TymeBank Personal Loans

TymeBank offers personal loan to South African citizens and permanent residents, with loan amounts ranging from R1,000 to R100,000 and loan terms between 12 and 60 months. To apply for a TymeBank personal loan, you need to provide your ID number, contact details, income and expenses information, employment history, and bank account details.

TymeBank typically responds to loan applications within 24 hours and disburses approved funds to your TymeBank account within 48 hours. The interest rate on TymeBank personal loans is variable and based on your credit score, with an APR that can go up to 25.9%.

Tyme Bank debit order reversal: TymeBank cannot reverse, refund or correct payments that were made to an incorrect cellphone number or to the wrong person. If the person you sent money to does not redeem the money within 7 days, the money will be reversed into your account at midnight on the 7th day (one week) after the transaction.

Tymebank Business Account

The TymeBank Business Account is specifically tailored to meet the banking needs of small and medium-sized businesses in South Africa. With the Business Account, businesses gain access to a range of transactional capabilities, including electronic fund transfers, debit card payments, and cash withdrawals.

To open a TymeBank Business Account, you must provide business registration documents that verify the legal registration of your business, such as a certificate of incorporation, partnership agreement, or sole proprietorship documents. Valid identification documents, such as ID cards, passports, or driver’s licenses, will also be required for the individuals associated with the business. You will also need to provide proof of address, which can be in the form of utility bills or official correspondence that displays your residential or business address.

MoreTyme

MoreTyme is a Buy Now, Pay Later (BNPL) service offered by TymeBank that allows you to buy items in over 5000 South African stores now and pay for them in three interest-free installments over 3 months without credit check. You can use MoreTyme to buy online or in-store with TymeBank.

To qualify for MoreTyme, you need to have a TymeBank account and a TymeBank card. When you make a purchase at a participating store, you can choose to pay with MoreTyme. 33.3% of the total purchase is deducted from your TymeBank account immediately, and the remaining balance is due in three equal installments over the next three months. There are no fees associated with using MoreTyme.

The TymeBank TFG Money Account

The TymeBank TFG Money account is a free transactional bank account that offers a variety of financial services to TFG customers. Through the kiosk, the TymeBank app, and other digital interfaces, you can make electricity payments, transfer money, and open savings accounts. The account also offers a Buy Now Pay Later option, TFG Rewards points, and the ability to open an account at any of the over 600 TFG stores across South Africa. Moreover, you can earn up to 8% interest on your savings with the TymeBank TFG Money account.

Tymebank GoalSave

TymeBank’s GoalSave is a savings account that offers competitive interest rates. You start earning 4% per annum from day one, which increases to 5% after 30 days and 6% after 90 days. By switching your salary to TymeBank and providing 10 days’ notice before withdrawal, you can earn up to 8% interest per annum. With GoalSave, you can open up to 10 accounts with a maximum balance of R100,000 each. There are no fees or penalties for accessing your money, and interest is earned from the first day.

You can open a TymeBank savings account online in under 5 minutes by downloading the TymeBank app and sign up with your personal information. You need a South African ID number, an active South African cellphone number, and you must be 16 years or older.

Tymebank Debit Card

The TymeBank debit card is a Visa card that can be used to withdraw cash from ATMs, make purchases at stores, and pay for online transactions. The card is free to use and there are no monthly fees. The TymeBank debit card is available in two colors: yellow and black. The yellow card is the standard card and the black card is a premium card that offers some additional benefits, such as travel insurance and airport lounge access.

To apply for a TymeBank debit card, you must have a TymeBank account. Once you have an account, you can order a debit card through the TymeBank app or website. The TymeBank debit card will be delivered to your home within a few days. You can activate the card by calling TymeBank customer support or by logging into the TymeBank app.

Tymebank SendMoney

TymeBank SendMoney is a feature that allows TymeBank customers to send money to other individuals or businesses conveniently. With SendMoney, you can transfer funds from your TymeBank account to another TymeBank account or to accounts at other banks in South Africa. If you need to send money to someone who does not have a TymeBank account, you can use TymeBank’s EFT service. The transaction fee for EFT is R5.00 per transaction.

TymeBank offers various methods to send money. One option is to use USSD by dialing 120543# on your mobile phone and following the prompts. Another method is through the TymeBank mobile app, where you can log in and select the “Send Money” option. Additionally, you can use TymeBank’s internet banking platform to log in and choose the “Send Money” feature. The transaction fee for sending money using TymeBank SendMoney is R1.50 per transaction.

Tymebank Health Insurance

TymeBank offers two health insurance plans: MediClub Premier and MediClub Classic. To be eligible for TymeBank health insurance, you must be a South African citizen or permanent resident and at least 16 years old. You must also have a TymeBank bank account and a valid South African ID number. You can apply for TymeBank health insurance online or at any TymeBank kiosk.

MediClub Premier offers comprehensive coverage for a monthly premium of R199 for adults and R149 for children, with a maximum benefit of R1 million per year. It includes doctor’s visits, hospital stays, day surgery, maternity care, and coverage for chronic conditions. Additionally, it provides benefits for accidental death and hospitalization.

On the other hand, MediClub Classic has a more affordable premium of R149 for adults and R119 for children. It covers doctor’s visits, hospital stays, day surgery, and maternity care, with a maximum benefit of R500,000 per year. However, it does not include coverage for chronic conditions or benefits for accidental death and hospitalization.

TymeBank Fees

TymeBank is known for its low-cost fee structure, offering competitive rates compared to traditional banks in South Africa. While specific fees may vary depending on the type of account and transaction, here are some of the common fees associated with TymeBank in 2023:

| Fee Type | Fee Amount |

|---|---|

| Monthly Fee | No fee |

| Cash Deposit | No fee |

| Initiation Fee | R160 |

| ATM Withdrawal (TymeBank ATMs) | R3 |

| ATM Withdrawal (Other banks’ ATMs) | R8 |

| EFT Fee (up to R10,000) | R7 |

| EFT Fee (above R10,000) | R15 |

| Debit Order Fee | R5 |

| SMS Notification Fee | R0.30 |

| Overdraft Fee | R200 |

| Late Payment Fee | R100 |

| Tymebank Card Replacement Fee (CPI) | R60 |

TymeBank Reviews

As of June 2023, TymeBank has received a rating of 4.2 out of 5 from 64.8K reviews on the Google Play Store. The app has been downloaded over 1 million times. Users have praised the app for its low fees, convenient features, and user-friendly interface. However, there have been reports of app instability, limited acceptance of TymeBank cards by some businesses, and concerns regarding customer service. It’s important to consider that these reviews represent a relatively small sample size.

More Information

Can a foreigner open a Tyme bank account?

Unfortunately, foreigners are not eligible to open an account with TymeBank, as it is specifically designed for individuals who hold South African citizenship or residency.

Where can I open Tymebank account?

You can open a TymeBank account online or at TymeBank kiosks located at Pick n Pay, TFG stores and Boxer stores.

Is there a Tyme Bank virtual card?

No, at the moment the bank does not offer virtual cards to its customers.

Can I withdraw Tymebank money at Shoprite?

No, you cannot withdraw TymeBank money at Shoprite. TymeBank does not have any partnerships with Shoprite to allow cash withdrawals at their stores. You can only withdraw cash at TymeBank ATMs, partner ATMs, Pick n Pay, TFG stores and Boxer stores or by using your TymeBank card at a retailer till.

Where can i deposit money for Tymebank?

To deposit money into your TymeBank account, you can use the TymeBank kiosks located at Pick n Pay and Boxer stores, or transfer funds from another bank account using the TymeBank app or internet banking.

What's MoreTyme?

MoreTyme is a Buy Now, Pay Later (BNPL) service offered by TymeBank that allows you to buy items in over 5000 South African stores now and pay for them in three interest-free installments over 3 months

How do I activate MoreTyme app?

To activate MoreTyme, you can either download the TymeBank app or log in to your TymeBank app. Once you are logged in, tap the MoreTyme card and then tap the "Apply" button. You will then be able to follow the instructions on the screen to activate MoreTyme.

What is TymeBank USSD code?

To buy airtime, pay bills, send money, and check balance on TymeBank account, dial *120*543# and follow the onscreen prompts.

Can I open a TymeBank account for my child?

TymeBank does not offer bank accounts to children under the age of 16.

How do I open TymeBank account online?

To open a TymeBank account online, you can follow these steps:

- Go to the TymeBank website.

- Click on the "Open an account" button.

- Enter your cellphone number and ID number.

- Click on the "Send me a code" button.

- Enter the code that you received on your cellphone.

- Create a password for your account.

- Read and agree to the terms and conditions.

- Click on the "Open account" button.

How much does it cost to open a TymeBank account?

It costs zero to open a TymeBank account. There are no monthly fees or account opening fees. You can also withdraw cash for free.

Is TymeBank legit?

Yes, TymeBank is a legitimate bank in South Africa. It is a fully-fledged bank that is regulated by the South African Reserve Bank (SARB). TymeBank is also a member of the Financial Services Board (FSB). It's the first fully digital bank in South Africa.