There are many ways to earn passive income with crypto. Cryptocurrencies such as Bitcoin can help you earn a passive income over time. A passive income is an income that you earn continuously without having to work for it consistently. For example, if you invest money that earns you interest at the end of the month, it is a passive income. In this article, we want to show you how to earn passive income with crypto, but also highlight some of the biggest mistakes many people have made before you.

What to know before considering renting out your coins

- Don’t trade or invest in bitcoin more than you can afford or willing to lose.

- The best way to protect your bitcoin is to “hodl” and only store in noncustodial wallets. Don’t leave your bitcoin in a third-party wallet. All bitcoin you store elsewhere apart from your personal wallet can be lost. Always have safe backups for when your wallet gets lost.

- Find out how we think you can retire early with bitcoin and become financially independent.

Crypto Interest Accounts

There are platforms that offer cryptocurrency interest accounts similar to bank’s savings accounts, where you earn a certain percentage of your crypto assets. For instance, Wirex allows you to earn up to 12% interest compounded daily on their Wirex X-Accounts.

If you wish to earn a passive income with crypto through this method, it is best that you consider diversifying your investment. This means that you can split your investment into several companies. It will ensure the safety of your investment and also get to enjoy some perks that may be offered by one company and are not offered by the other.

Remember though that your coins are often not insured. You are giving away your cryptocurrency coins for others to invest with. Most often to institutional investors so they can leverage from that. But there is no guarantee to get back your crypto. The business can go bankrupt, and they can invest your money in many bad ways. Remember: not your keys, not your coins. It is advisable to keep on stacking your SATs as it is not risky.

Best Crypto Interest Account

You can earn a passive income from these selected top crypto interest accounts:

How to Make Passive Income with Crypto Lending

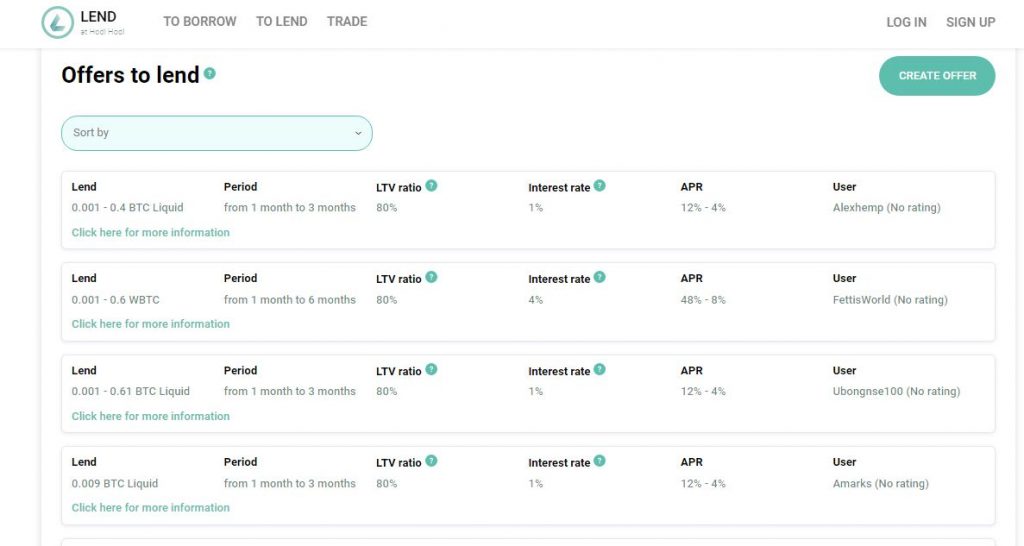

You can make passive income with bitcoin lending. Basically, you offer your cryptos to borrowers looking for cryptocurrency or fiat currency loans. You need to sign up on a peer-to-peer lending platforms and start investing in crypto loans.

There are two main types of platforms for crypto lenders to use, DeFi (decentralized finance) and CeFi (centralized finance). CeFi platforms act as a middleman between you, a crypto lender, and borrowers. Therefore, they usually take control of your cryptos and collateral for the duration of the loan. They are generally not anonymous. DeFi platforms are non custodial because they don’t take control of your cryptos or collateral, but instead use smart contracts to lock the involved crypto assets until the loan is paid in full. They are generally anonymous as they don’t require KYC.

You need to take your time to compare different crypto lending platforms and choose the one that offers the best interest rate for your cryptos and the one that is safe and legit. Some platforms allow lenders to set their own interest rates, while others are fixed by the platform.

Best Crypto Lending Platforms

- Lend at Hodl Hodl

- Alchemix

- Aave (open source crypto lending platform)

- MoneyToken

- DeFi Rate (a trusted resource providing nontechnical users with insights into leading DeFi projects)

Cryptocurrency Staking

We strongly advise you to trade or invest only in bitcoin as a long-term investment. Cryptocurrency staking is a risky investment that could result in the loss of your funds. Altcoins, cryptocurrencies that are not bitcoin, are copy-cats, scams or simply nonsensical, avoid them. See our take on going bitcoin-only and How To Achieve Financial Independence and Retiring Early (FIRE) by stacking sats.

Staking cryptocurrency is keeping your crypto in the mining pool of a crypto platform or wallet for a certain period to earn rewards or interest. For example, users of Cyrpto.com or holders of Crypto.com crypto cards can earn up to 12% annually on CRO staking (CRO is the native token of Crypto.com). You can also earn up to 5.0% APR on Ethereum 2.0, Tezos, Cosmos, etc., from crypto staking on Coinbase, one of the largest crypto exchange in the US.

Crypto Staking Platforms

Best platforms where you can earn passive income staking crypto are the following:

Joining Affiliate Programs

You can earn a passive income for promoting a crypto platform. For every new user you bring to the platform, you earn a crypto commission. You can run affiliate programs using affiliate links and referrals on social media, website or even blogs.

Crypto Affiliate Programs

Some of the crypto affiliate programs you can join include:

- Binance Affiliate Program

- Paxful Affiliate Program

- YouHolder Affiliate Program

- Bitpanda Affiliate Program

- Nexo Affiliate Program

Crypto Mining

Bitcoin mining or crypto mining is a way of earning cryptocurrency after taking part in the process of verifying cryptocurrency transactions on the blockchain network. It requires the use of sophisticated and advanced computing power to solve complex mathematical problems in order to authenticate crypto transactions. You will also need strong internet connectivity and also data storage.

Crypto mining has become complicated, necessitating the development of sophisticated computers. If you wish to mine Bitcoin, it is best that you join advanced Bitcoin miners within the crypto industry. This way, you will be generating some revenue based on the percentage of computing power you offered in the mining process. The stiff competition in crypto mining, cost of electricity, cost of equipment and the complexity of the actual mining process have made it less profitable and challenging to generate enough revenues.

As a way of controlling the introduction of new Bitcoins into circulation, the network protocol halves the number of Bitcoins awarded to miners for successfully completing a block about every four years.

Initially, the number of Bitcoins a miner received was 50. In 2012, this number was halved, and the reward became 25. In 2016, it halved again to 12.5. In May 2020, the reward halved once again to 6.25, the current reward. Prospective miners should be aware that the reward size will continue to decrease in the future, even as the difficulty is liable to increase. – Investopedia.

Crypto Mining Platforms

There are many crypto mining platforms and crypto mining software that you can use if you don’t have enough resources to do it on your own. Some of the platforms for passive income crypto mining are:

- NiceHash

- Slushpool

- CryptoTab Browser (it allows you to mine while browsing)

- Ecos

- Bitfly

Bitcoin Payments

Many companies and freelancers are accepting Bitcoin payments. Big companies that accept Bitcoin payments include Tesla, Wikipedia, Starbucks, Shopify, Etsy among others. By accepting Bitcoin payments as a freelancer, you can earn passive income on your crypto assets by “hodling”. Hodling is the practice of keeping your cryptos without selling until when their prices increase. For instance, if you hold some Bitcoins in your cryptocurrency wallet and their prices increase, it means you can sell them at a higher price. You simply buy low and sell high.

If you choose not to sell your Bitcoins or other cryptos, some crypto companies such as Hodlnaut allow you to earn interest. Hodlnaut’s feature, Preferred Interest Payout, allows users to deposit any cryptocurrency from the supported cryptocurrencies (BTC, ETH, USDT, DAI, USDC, and WBTC) and choose to passively earn interest in the asset of their choice.

Trading in Bitcoin

Trading in Bitcoin is the commonest way to earn a passive income with Bitcoin. There are many crypto-trading platforms and crypto-friendly banks such as Coinbase and Revolut you can use for crypto trading.

The variation in Bitcoin prices across various exchange platforms allows Bitcoin traders to make profits. Traders buy Bitcoins from exchange platforms with lower prices and sell them in platforms with higher prices. This is a strategy that requires a lot of research to generate revenues. Fortunately, you can use crypto trading bots and platforms such as Cash App and Cryptohopper that allow you to automatically buy and sell cryptocurrency for profits. Crypto auto trading happens without much effort on your side.

Cryptocurrency Airdrops

An airdrop is a marketing campaign in which a cryptocurrency project distributes free tokens to the public. Airdrops are often used to raise awareness of a new cryptocurrency project and to attract new users. Cryptocurrency airdrops are often scams. These scams typically ask you to provide your cryptocurrency wallet address or to complete a task in order to receive the free tokens. Once you have provided your wallet address or completed the task, the scammers will steal your cryptocurrency. Do your research before participating in any airdrop.

Crypto airdrops are some kind of marketing strategy that involved giving out a few coins for promoting a cryptocurrency. You can earn a passive income through airdrops for doing nothing apart from just holding some tokens or promoting them on social media. Cryptocurrency companies, particularly new ones, sometimes look for members who promote their coins and send them small amounts of the tokens.

Crypto Airdrops Platforms

Passive Income with Crypto: What You Need to Know

There may be many ways to make passive income with crypto. It is also important to remember that passive income is not guaranteed. The value of your crypto assets can fluctuate, and the rates of return offered by passive income strategies can change. Also, if you give out access to your private keys, you can lose all your assets. Therefore, it is important to think of strategies to keep your private keys, diversify your investments, research thoroughly, and be aware of regulations and taxes. Success requires patience, learning, and adapting to changing markets. Consider seeking advice from experts in crypto investments to manage risks and potentially earn passive income. Only invest money that you can afford to lose.