Blockchain technology has garnered both praise and skepticism, and it’s essential to explore its core elements and applications. At its core, a blockchain is indeed a decentralized database, although its level of decentralization can vary. While this description might seem simplistic, the real value of blockchain becomes evident when considering its broader implications, particularly in the context of Bitcoin.

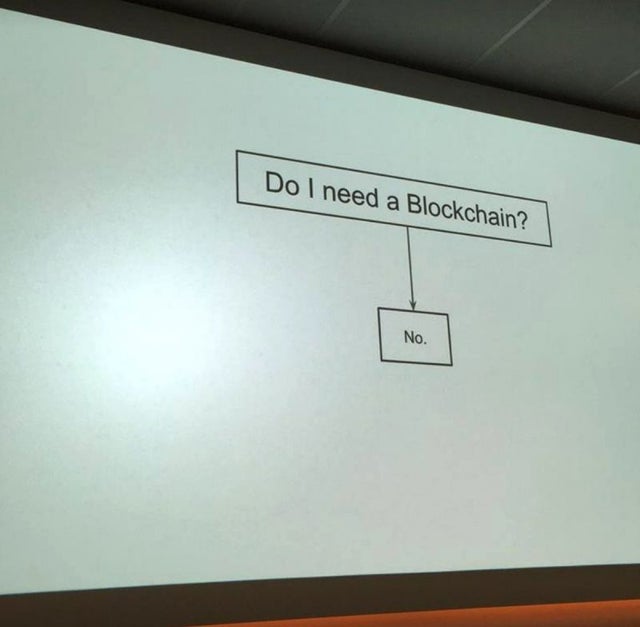

Blockchain is bullshit. If you weren’t aware yet, a blockchain is simply a decentralized database. Not even that decentralized. You read that correctly, a blockchain is a database. The only way it makes sense is in the context of Bitcoin. Yet, many people are selling the snake oil.

The Essence of a Blockchain

However, it’s crucial to acknowledge that the blockchain space has seen its fair share of overhyped claims and misrepresentations. Let’s delve into the essence of blockchain

In essence, a blockchain offers a unique approach to transactions, which can be significantly advantageous compared to traditional centralized systems. These conventional systems often suffer from time-consuming processes, high expenses, and consumer frustration due to fees and overhead, impacting profit margins.

Blockchain technology provides a secure alternative that challenges the need for expensive client-server setups, prevalent in many financial interactions today. For instance, when used for cross-border payments in Bitcoin’s distributed network model, each node takes on the responsibility of authentication and broadcasting. Furthermore, clients with private keys can enjoy enhanced privacy, as they avoid sharing excessive personal data, all while benefiting from a network inherently more secure due to the absence of a vulnerable centralized server.

Traditional client-server networks, on the other hand, often rely on intricate and costly protocols to maintain security. Transactions can take several days to process, disrupting supply chains, and clients are typically required to divulge personal information during account setup, increasing expenses unnecessarily.

In summary, while blockchain’s fundamental concept is a decentralized database, its real value lies in the potential to streamline processes, enhance security, and challenge traditional systems. However, it’s essential to approach blockchain technology with a discerning eye, recognizing its suitability for specific use cases rather than viewing it as a universal panacea.

With Traditional Payment Services

- You are forced to wait until slower transfers clear to finalize transactions

- You pay high fees for transactions between countries

- You are responsible for managing a centralized network

- You assume responsibility for security and storage of account information

- Users are required to create accounts/Provide sensitive information

With Blockchain Services

- Transactions are instant and trackable

- Overhead is reduced due to the distributed network

- Transaction histories are recorded in each blockchain

- Clients only need their passkey to initiate transactions

- With Bitcoin for cross-border payments, cross-border transactions are secure and simple

Why Consider a Blockchain?

What is a blockchain, and why should you consider it for money transfers? Blockchain technology, exemplified by services like Ripple Transaction Protocol (RTXP) and other blockchain networks, has revolutionized cross-border payments by addressing some key challenges, primarily transaction fees and security.

Traditionally, transaction fees have been a significant barrier to efficient cross-border money transfers. However, blockchain technology has transformed this landscape. Notably, blockchain transactions are not only highly secure but also come with almost negligible transaction fees, often approaching the concept of being fee-free. Unlike conventional payment systems prone to chargebacks and additional costs, blockchain-based platforms offer a cost-effective solution.

Blockchain systems like Ripple operate on a distributed network model that records the entire transaction history for each account in a single, continuously updated file. This file is shared among network nodes, eliminating the need for a central server for authentication and verification. Consequently, blockchain-powered transactions are lightning-fast, hassle-free, and maintain airtight security while significantly reducing costs.

In summary, blockchain technology, as exemplified by Ripple and similar platforms, has paved the way for more efficient, secure, and cost-effective cross-border money transfers. By eliminating the traditional pain points associated with transaction fees and security, blockchain is redefining the future of international financial transactions.

- Transactions are instant and trackable

- Overhead is reduced due to the distributed network

- Transaction histories are recorded in each blockchain

- Clients only need their passkey to initiate transactions

- With Bitcoin for cross-border payments, cross-border transactions are secure and simple

Small and medium-sized businesses

Small and medium-sized businesses (SMBs) contemplating the question, “Why use blockchain for money transfer?” are uncovering a transformative shift in the payments landscape, one that is breaking down traditional size barriers. Today, businesses of all sizes find themselves in a situation where the old constraints persist: waiting for funds as wire transfers can take up to three days, necessitating larger working capital reserves, and grappling with supply chain inefficiencies due to antiquated systems.

However, the emergence of blockchain-based cross-border payment systems is changing the game. These innovative systems virtually eliminate wait times, replacing them with near-instantaneous transactions. They also slash high transaction fees that have long plagued traditional methods. More importantly, blockchain offers a simpler and more secure alternative to outdated systems, ushering in an era of financial efficiency for businesses, regardless of their size.

In essence, blockchain technology is leveling the playing field for SMBs and larger enterprises alike, redefining the way money moves across borders and heralding a new era of financial freedom and efficiency.

Blockchain FAQs

How trustworthy is blockchain?

Blockchain is a decentralized ledger technology that is used to record transactions in a secure and transparent way. It is based on cryptography, which makes it very difficult to tamper with the data.

Blockchain is trustworthy because it is tamper-proof and decentralized. This means that it is very difficult for anyone to hack or manipulate the data. Additionally, blockchain is transparent, so anyone can view the transactions that have been recorded on the blockchain.

Can blockchain be hacked?

Blockchain can be hacked, but it is very difficult. Blockchain technology is based on cryptography. This makes it very difficult to tamper with the data on the blockchain.

In order to hack a blockchain, an attacker would need to control more than 50% of the computing power on the network. This is very difficult to do, as blockchain networks are spread out across the globe. Additionally, blockchain networks are constantly being updated with security patches. This makes it more difficult for attackers to exploit vulnerabilities in the network.

What is the biggest problem in blockchain?

The biggest challenges in blockchain technology include scalability issues, energy consumption concerns, interoperability difficulties, regulations challenges, limited adoption, user-friendliness issues, privacy considerations, high costs, and legal/ethical dilemmas.