The Single Euro Payments Area (SEPA) is a payment system of the European Union for bank transfers in euro. Instant SEPA bank-transfers take place within 10 seconds. As of 2023, there were 36 members in SEPA. See the full list below. SEPA is managed by the European Commission and the European Central Bank (ECB). SEPA was created to fully harmonise electronic euro payments to make it as easy and convenient for citizens and businesses to pay across Europe with one payment account and one card as it is in their home countries.

If you don’t live in the SEPA zone, you can still open a non-resident virtual bank account with an International Bank Account (IBAN) in Europe and be able to make Euro transfers without a fee. A non-resident virtual bank account in Europe gives you access to euro payments from EU countries through SEPA. Some virtual banks allow you to re-route money back to your local bank account within 24 hours.

History of SEPA

In 2007, the European Union passed the Payment Services Directive. The Directive formed the legal basis for the establishment of SEPA. In 2011, SEPA payments replaced national payments and in 2017, SEPA launched a program whereby banks would transfer up to 15,000 euros in ten seconds.

In 2018, the European Commission proposed to extend rules forbidding banks to charge extra cross-border transaction fees to non-EU countries. This gave EU citizens the right to transfer euros across borders at the same cost as they would pay for a domestic transaction. In addition, the new rules required that consumers are informed of the cost of a currency conversion before they pay abroad in a currency different from their home currency.

Difference Between SEPA and SWIFT

SWIFT enables money transfers internationally, while SEPA payments can only be made within the SEPA zone. SWIFT transfers can be executed in various currencies, while the SEPA transfers are in euro only. The recipient’s account number in SEPA transfers is required to be in the IBAN format. For more information, please refer to the article What is the difference between SEPA and swift?.

SEPA Charges

There are no charges or costs for using SEPA payments, however a limited number of banks do ask for a small fee to make transfers. Since 2001, banks are not allowed to make any deductions from the amount transferred, meaning that if no fee is added, no costs are being charged. Banks and payment institutions still have the option of charging a credit-transfer fee of their choice for euro transfers if it is charged uniformly to all participating banks and payment institutions. Sweden and Denmark have legislated that euro transfers shall be charged the same as transfers in their own currency.

In 2009, the European Parliament mandated that charges respecting cross-border payments in euros (of up to EUR 50,000) between EU member states shall be the same as the charges for corresponding payments within the member state.

Benefits of SEPA for Consumers and Businesses

SEPA provides many benefits to both consumers and businesses.

- Cost-effective harmonised payment system

- Simplicity and convenience

- SEPA allows for cross-border transfer without incurring charges as if one is making a transfer to a local bank

- SEPA Direct Debit allows merchants to ensure that customers will pay their bills on time every month

- SEPA eliminates failed payments due to card expiry or cancellation

- SEPA reduces administrative time, for instance, in updating card details

- Payers can get a refund from their bank for unauthorised SEPA payments for up to 13 months

How SEPA Works

SEPA payment clearance uses the International Bank Account Numbers (IBAN). Payment methods with additional optional features or services such as mobile phone or smart card payment systems, are not directly covered. To make SEPA payments, you only need to have the payee’s bank details in the international format. Most SEPA transfers take 1-2 business days to arrive in the beneficiary’s bank account. There is no limit on amount of payments to be made using SEPA.

International Bank Account Number (IBAN)

- IBAN is an internationally agreed system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a reduced risk of transcription errors.

- It was originally adopted by the European Committee for Banking Standards (ECBS) and later as an international standard.

- An IBAN consists of up to 34 alphanumeric characters comprising a country code; two check digits; and a number that includes the domestic bank account number, branch identifier, and potential routing information.

Types of SEPA Payments Schemes

SEPA payments fall under the following schemes.

- SEPA Credit Transfer (SCT) allows for the transfer of euros from one bank account to another with IBAN codes. Payments made before the cut-off point on a working day will be credited to the recipients account by the next working day

- SEPA Instant Credit Transfer (SCT Inst) or SEPA Instant Payment provides for instant crediting of a payee in less than ten seconds and up to a maximum of twenty seconds

- SEPA Direct Debit functionality is provided by two separate schemes. The basic scheme, Core SDD, is primarily targeted at consumers. The second scheme, B2B SDD, is targeted towards business users. There are no card networks involved in the SEPA Direct Debit scheme because communications happen directly between banks. SEPA Direct Debt payments are not instant.

A SEPA debit transfer is a recurring payment within the EU. It is pre-authorised, automatic payments one can use to pay fixed expenses, such as rent. The scheme eliminates the risk of missing a payment deadline and incurring late payments fees.

SEPA Charges

There are no charges or costs for using SEPA payments. Since 2001, banks are not allowed to make any deductions of the amount transferred. Banks and payment institutions still have the option of charging a credit-transfer fee of their choice for euro transfers if it is charged uniformly to all participating banks and payment institutions. Sweden and Denmark have legislated that euro transfers shall be charged the same as transfers in their own currency.

In 2009, the European Parliament mandated that charges respecting cross-border payments in euros (of up to EUR 50,000) between EU member states shall be the same as the charges for corresponding payments within the member state.

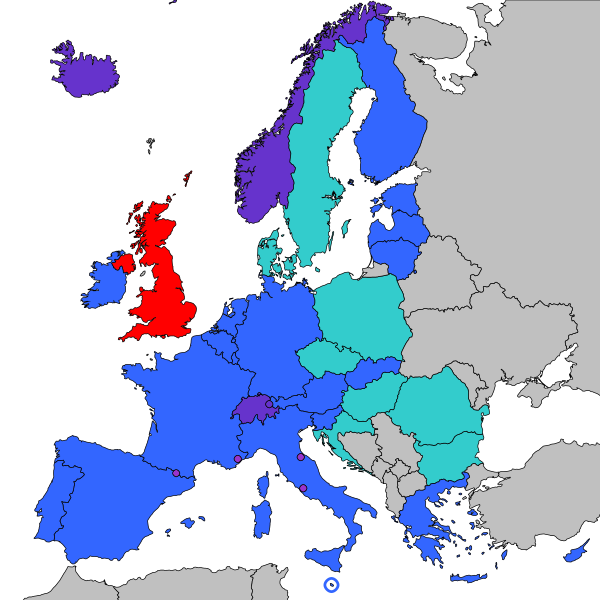

SEPA Countries List 2023

Here’s a list of countries in the SEPA zone, including codes for IBAN and the country’s currency.

| COUNTRY/TERRITORY | IBAN | CURRENCY CODE |

|---|---|---|

| Åland Islands | FI | EUR |

| Andora | AD | EUR |

| Austria | AT | EUR |

| Azores | PT | EUR |

| Belgium | BE | EUR |

| Bulgaria | BG | BGN |

| Canary Islands | ES | EUR |

| Croatia | HR | HRK |

| Cyprus | CY | EUR |

| Czech Republic | CZ | CZK |

| Denmark | DK | DKK |

| Estonia | EE | EUR |

| Finland | FI | EUR |

| France | FR | EUR |

| French Guiana | FR | EUR |

| Germany | DE | EUR |

| Gibraltar | GI | GIP |

| Greece | GR | EUR |

| Guadeloupe | FR | EUR |

| Guernsey | GB | GBP |

| Hungary | HU | HUF |

| Iceland | IS | ISK |

| Ireland | IE | EUR |

| Isle of Man | GB | GBP |

| Italy | IT | EUR |

| Jersey | GB | GBP |

| Latvia | LV | EUR |

| Liechtenstein | LI | CHF |

| Lithuania | LT | EUR |

| Luxembourg | LU | EUR |

| Madeira | PT | EUR |

| Malta | MT | EUR |

| Martinique | FR | EUR |

| Mayotte | FR | EUR |

| Monaco | MC | EUR |

| Netherlands | NL | EUR |

| Norway | NO | NOK |

| Poland | PL | PLN |

| Portugal | PT | EUR |

| Réunion | FR | EUR |

| Romania | RO | RON |

| Saint Barthélemy | FR | EUR |

| Saint Martin (French part) | FR | EUR |

| Saint Pierre and Miquelon | FR | EUR |

| San Marino | SM | EUR |

| Slovakia | SK | EUR |

| Slovenia | SI | EUR |

| Spain | ES | EUR |

| Sweden | SE | SEK |

| Switzerland | CH | CHF |

| United Kingdom | GB | GBP |

| Vatican City | VA | EUR |

The following countries have special territories which are not part of SEPA:

- Cyprus: Northern Cyprus is excluded.

- Denmark: the Faroe Islands and Greenland are excluded.

- France: the French Southern and Antarctic Lands, French Polynesia, New Caledonia and Wallis and Futuna are excluded.

- Netherlands: Aruba, the Caribbean Netherlands, Curaçao and Saint Martin are excluded.

- Norway: Svalbard and Jan Mayen are excluded.

- United Kingdom: British Overseas Territories are excluded, save for Gibraltar and the Crown dependencies.

These are jurisdictions using the euro that are not in SEPA: Akrotiri and Dhekelia, French Southern and Antarctic Lands, Kosovo, and Montenegro.

SEPA, the UK and Brexit

- The European Payments Council has approved the continued participation of the UK in the SEPA payment schemes in the event that the UK leaves the EU without a trade agreement in place.

- The UK left the EU on January 31, 2020 and entered an 11-month implementation period under the terms of its withdrawal agreement with the EU. During this implementation period, EU law will continue to apply in the UK.

- From January 1, 2021, subject to any trade agreement entered into between the EU and the UK, the UK will be treated as a “third country” under the rules of SEPA.

Non-SEPA Countries List 2023

Not all European countries are part of the SEPA zone. Here’s an extended list of the European countries that are not in SEPA:

- Albania

- Armenia

- Azerbaijan

- Belarus

- Bosnia and Herzegovina

- Georgia

- Kazakhstan

- Kosovo

- Moldova

- Montenegro

- North Macedonia

- Russia

- Serbia

- Turkey

- Ukraine

More Information

The Single Euro Payments Area has revolutionised payments in the SEPA zone. SEPA allows individuals and businesses to make payments conveniently, faster and cheaper. The system is constantly improved. For example, payment platforms such as mobile and online payments are being harmonised. Interested in knowing more, please refer to the official SEPA website.

SEPA FAQs

What is SEPA area?

The SEPA area, which stands for the Single Euro Payments Area, is a zone consisting of multiple European countries within the European Economic Area (EEA) plus Norway, Iceland, and Liechtenstein where individuals, businesses, and banks can make and receive euro payments under the same basic conditions. It was created to make it easier and cheaper for people and businesses to make and receive euro payments within the area.

What is the difference between a SWIFT and SEPA payment?

SWIFT and SEPA are two different payment systems that are used to transfer money internationally. SWIFT is a messaging network that connects banks and other financial institutions around the world. SEPA is a payment system that allows for the electronic transfer of euros within the European Economic Area (EEA). SWIFT payments can be made in any currency, while SEPA payments can only be made in euros.

Is the UK a SEPA country?

Although the UK is no longer a member of the European Union, it is still a SEPA country.

Is Sweden a SEPA country?

Sweden, as an EU member, is part of SEPA.

Is Bulgaria a SEPA country?

As a member of EU, Bulgaria is a SEPA country.

Is Turkey in SEPA?

Turkey is not a member of the EU or the EEA, which means it is not a SEPA country.

What is the meaning of SEPA credit transfer?

SEPA Credit Transfer (SCT) is a standard method to transfer money between bank accounts within the Single Euro Payments Area (SEPA).

What is the difference between SEPA and Non SEPA?

SEPA payments are in euros only, while non-SEPA payments accept any currency. SEPA transfers are typically faster, while non-SEPA transactions can be slower, taking days or weeks.