Bunq and Revolut are two popular mobile banks that offer virtual bank accounts and allow users to spend, send, and save money. For a long time now, we have been using both and would like to share with you what, we think, can add value to your banking experience.

Bunq and Revolut are alike because they both offer online bank accounts without physical branches. They make it easy to open an account and provide you with access to different payment cards. They also offer ways to save and invest money at low costs. However, they are different in how they charge for their services and the extra stuff you can do in their apps.

Here are the key points to remember:

- Revolut offers a free plan with basic banking features like multiple cards, transfers, and payments. Its premium plans start at €3.99 per month.

- Bunq’s free service covers only your savings account. A premium account is needed to get a full privilege bank account, which starts at €2.99 per month.

Revolut is already available to customers in the US, while Bunq has applied for a banking license in the USA and is not available in the US yet. This comparison, however, specifically discusses their services for European customers.

What are the Main Differences Between Bunq and Revolut?

Bunq, established in 2012 by Ali Niknam in Amsterdam, Netherlands, is a mobile bank. It provides a savings account with interest earnings and offers multiple EU IBANs, including options like German, French, Spanish, Irish, and Dutch bank account numbers.

Revolut, on the other hand, is a digital bank founded on July 1, 2015, by Nikolay Storonsky from Russia and Vlad Yatsenko from Ukraine. Revolut is well-known for its money management tools and investment opportunities. Additionally, Revolut provides local banking account details for the UK and countries within the EU and EEA. However, it’s worth noting that for the EU and EEA countries, the options are limited to Dutch or Lithuanian bank account numbers, and you can’t choose.

How Does Bunq and Revolut Savings Account Compare?

Bunq provides a free savings account, but its current account is available for a minimum of €2.99 per month. You can deposit money into your savings account using various methods such as Ideal, Sofort, Apple Pay, Google Pay, credit cards, or bank transfers (including SEPA), and it offers an interest rate of 2.46%, paid out weekly. There’s no need for a minimum deposit, and your deposits are insured up to €100,000. If you get a premium account, they reward you with higher interest rates. The good thing is that the interest you receive can also pay for your premium account if you deposit just a couple of thousand euros.

Revolut does something different here, something we are not really fond of, to say the least. It does not offer a savings account in the traditional sense, but has a “flexible” investment account that it markets as a savings account. Returns are relatively high for a savings account, but they are in no way guaranteed, and it also states that your ‘capital is at risk.’ Additionally, interest rates of 5.34% it advertises are only available with the highest plan, which comes at a €50 monthly fee. To be fair, we are not entirely sure what to make of this. See for yourself.

Revolut’s Confusing Savings vs. Bunq’s Clarity

Based on this experience, we find Revolut’s product offering confusing. While it claims to offer a savings account, the fine print makes it clear that it is, in fact, an investment account with the warning that ‘The value of investments can go up as well as down, and you may receive less than your original investment or lose the value of your entire initial investment.’ In this light, Bunq is clearly the winner compared to Revolut, thanks to its much clearer messaging and the offer of a genuine, interest-based savings account.

Get 3-Month Revolut Premium Trial

Comparison Between the Main Features

Bunq and Revolut provide distinct banking experiences, with some similarities and differences in their app features.

Bunq offers local IBANs in 16 different currencies, and it allows you to create subaccounts for better financial management. For instance, you can have multiple bank accounts within one premium account for various purposes like fixed costs and shopping, making budgeting easier. Bunq also offers additional services like a payment sorter, travel assistant, and multi-currency savings.

Revolut, on the other hand, offers banking services with a multicurrency IBAN that supports 25 currencies, although it doesn’t provide the feature of different accounts like Bunq. You can access Revolut’s features through the app or web, and it supports investment opportunities in both stocks and cryptocurrencies. You can use Revolut for stock and cryptocurrency trading, and it even allows you to virtually buy gold and silver through the app.

Bunq’s joint account feature allows four people to share either four Easy Money accounts or a mix of three Easy Money accounts and one Business account, making it easy to manage finances together. Each member gets their own bunq card for payments. Parents can also involve their kids in banking by sharing an account. In contrast, Revolut’s joint account option is for two people only, simplifying expense-sharing, but both must live in the same country and can’t be part of another joint account. Bunq emphasizes inclusivity and collaborative finance, while Revolut focuses on straightforward expense-sharing for smaller groups.

Annoying notifications

It’s worth mentioning how often both banks send notifications, including those related to interest received and marketing. Bunq lets you conveniently disable these notifications within the app and choose which ones you want to receive, which helps reduce phone distractions. On the other hand, with Revolut, we couldn’t locate a similar feature, so we had to turn off all notifications through the phone’s settings.

How Bunq Card Compares with Revolut Card

Both Bunq and Revolut offer physical and virtual cards. Bunq is the only one that allows you to order a credit card, not just debit cards. You can order either a MasterCard Credit card or MasterCard debit card, and many extra virtual cards but no single-use cards. Bunq cards can give you 2% cashback on public transport when you are using Easy Green or 1% cashback on restaurants or bars when you are using the Easy Money premium account.

Revolut offers both physical and virtual cards. Your first Revolut card is included for free in the free plan, but any additional or replacement cards will cost $4.99 each, along with a delivery fee. With any of the premium plans, these cards are provided at no extra cost. You have control over your cards using the app, including the ability to create multiple virtual cards and single-use cards. Furthermore, you can use your card for payments through Apple Pay or Google Pay.

Fees and Pricing: Premium Accounts Confusion

When it comes to the premium accounts offered by both Bunq and Revolut, it can get confusing for users because they each provide different perks. Comparing them isn’t straightforward because they cater to different needs. We recommend carefully comparing the various plans to determine which one aligns best with your requirements.

One observation is that Revolut’s premium account may not offer significantly more benefits compared to the free account, and many users find the free account sufficient. However, with Bunq, the experience is distinct. Their premium account, known as Easy Green, provides a comprehensive set of features that can cover all your banking needs, making it a compelling option for those seeking a more all-in-one banking solution.

Check out Revolut Pricing plans

Revolut Fees vs Bunq Fees

Both Revolut and Bunq offer free online bank account opening and free virtual bank account for personal or business accounts. Apart from their free plans, other plans attract monthly fees as shown below:

Bunq Fees

| Bunq Accounts | Monthly Fee (Personal) | Monthly Fee (Business) |

|---|---|---|

| Bunq Easy Savings | €0.00 | €0.00 |

| Bunq Easy Bank | €2.99 | €6.99 |

| Bunq Easy Money | €8.99 | €12.99 |

| Bunq Easy Green | €17.99 | €22.99 |

| Joint Account | €23.99 | €23.99 |

Revolut Fees

| Revolut Accounts | Monthly Fee (Personal) (Europe) | Monthly Fee (Business) (Europe) | Monthly Fee (Personal) (US) | Monthly Fee (Business) (US) |

|---|---|---|---|---|

| Standard | Free | Revolut Basic: £0/month | Standard $0.00/month | Basic $0/month |

| Plus | €3.99 | Revolut Grow: €25/month | Plus $3.99/month | Grow $30/month |

| Premium | €9.99 | Revolut Scale: €100/month | Premium $9.99/month | Scale $119/month |

| Metal | €15.99 | Revolut Enterprise: Custom | Metal $16.99/month | Enterprise: Custom |

| Ultra | €45.00 | – | – | – |

| Joint Account | Free | Free | – | – |

| Junior Account | Free | – | – | – |

Possibilities of Investment Opportunities

Revolut does offer investment features, allowing you to trade stocks and cryptocurrencies, and even buy virtual gold and silver. However, it’s crucial to note that Revolut profits from every investment transaction, which may not be ideal for making investments. They stand to gain when there’s a market panic, which is why they prominently display market fluctuations on their app and send notifications when prices drop. This can create a more stressful experience, which may not be suitable for those looking for a less stressful financial life.

Additionally, Revolut’s fees are relatively high compared to other investment platforms. So, if you’re looking for a more favorable and less stressful investment experience, it might be a wise decision to explore alternatives to Revolut and avoid such easily accessible solutions.

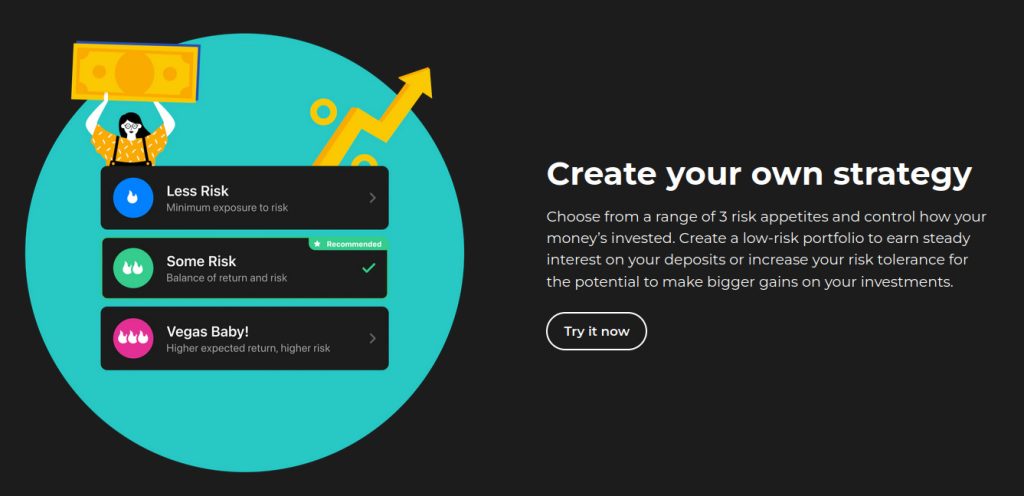

With Bunq, you can put your spare change into investment and let your money earn more effortlessly. Every time you spend, your payments will be rounded off to the nearest € and the difference will be added to your investment portfolio. Bunq also allows you to create a low-risk portfolio so that you can earn interest on your deposits and control how your money is invested. You can monitor your investments in real-time directly from the app.

Check out Bunq Investment Options

From our experience with investments, Bunq offers a level of peace of mind that comes from avoiding the gamble of individual stock trading. Bunq simplifies investing with three portfolio choices based on your strategy, in partnership with Birdee. The annual cost of investing stands at 0.99%, which is competitive compared to other investment solutions offering similar investment accounts. These three portfolio strategies include:

- Less Risk: Lower risk with a lower expected return.

- Some Risk: Offers a balance between risk and return stability.

- Vegas Baby!: Involves more risk with a higher expected return.

Our experience with these options.

In essence, our perspective is that individuals serious about investing may find better alternatives to Revolut among other investment platforms. However, if you’re just starting your investment journey and seek a hassle-free solution, Bunq can provide a more favorable experience compared to Revolut.

What are the Similarities Between Bunq and Revolut?

- SEPA Instant Payments: Bunq and Revolut both support SEPA instant payments. With a Revolut Euro account, you can make instant SEPA payments without any extra fees. Instant SEPA payments ensure your bank transfers happen instantly when the receiving bank also supports it.

- Mobile App: Both Revolut and Bunq have mobile apps available on the Google Play Store and App Store. You can use these apps to access all your banking services. Please note that both apps tend to promote additional services, which can clutter the user experience.

- Customer Support: Both Bunq and Revolut provide customer support. You can reach Revolut via email or phone, while Bunq offers 24/7 customer support through email and chat.

- Security: Both Bunq and Revolut prioritize security in their banking services. With Bunq, your deposits are protected up to €100,000 through the Dutch Deposit Guarantee Scheme (DGS). Revolut is regulated by the FCA (Financial Conduct Authority) and your money is guaranteed by the Lithuanian State Company Deposit and Investment Insurance.

- Business Accounts: In addition to personal account, they both offer business accounts.

- US Customers: While Revolut is already serving US customers, Bunq has applied for a US licence and it’s expected to be operational soon.

What Do People Say about Revolut vs Bunq?

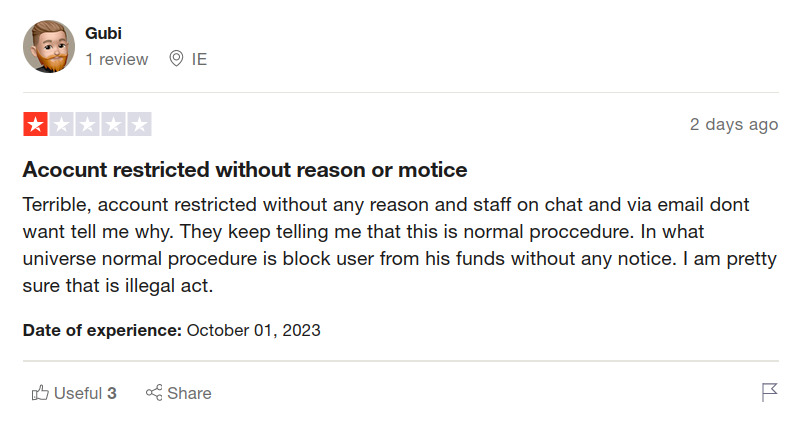

Many user reviews for both Bunq and Revolut frequently revolve around two major issues: sudden account closures and dissatisfaction with customer support. While Revolut generally receives more positive feedback regarding customer support, it still has its share of users expressing concerns about account closures. In contrast, Bunq seems to have fewer instances of account closures, based on the information we’ve gathered.

Bunq: As of January 5, 2024, Bunq had a rating of 3.5 on Trustpilot. Many reviewers appreciate Bunq for its features, especially its savings and basic transaction plans. However, there are complaints about slow customer service responses, with some criticizing the lack of phone support. Play Store reviews also highlight concerns about the absence of human customer support during emergencies. In addition, Bunq tends to “forget” to warn you to downgrade your plan after your free trial. If this happens, in our experience, you do get a refund when you say you did not intend to have this particular premium account.

Revolut: As of January 5, 2024, Revolut had a rating of 4.2 on Trustpilot. Numerous reviewers commend the bank for its user-friendly features, expense management, and investment options. They also praise the bank’s responsive customer support. However, there are complaints about customers’ accounts being terminated without clear reasons. We also find the same concerns when browsing Revolut’s Subreddit. This means that your account can get locked for a period of time, leaving you without access to your funds. If Revolut is your only account, this situation could put you in a financially difficult position.

Which is Better, Bunq or Revolut?

The choice between Bunq and Revolut depends on your specific needs and priorities. Both banks offer a range of features and services, but they have distinct strengths and weaknesses.

If you value a simpler, more streamlined banking experience with a focus on savings and low-risk investments, Bunq may be the better choice for you. Bunq’s savings features, easy investment options, and user-friendly interface cater well to individuals who are new to investing or prefer a less complex approach.

On the other hand, if you are looking for a broader range of financial services, including cryptocurrency trading, stocks, and a versatile multicurrency account, and are comfortable with a slightly more complex interface, Revolut could be the preferred option. Revolut’s diverse offerings make it attractive for those who want to manage multiple aspects of their finances within one app.

However, it’s crucial to consider that both banks have received mixed reviews regarding customer support and account closures. While Revolut generally fares better in customer support, account closure issues have been reported by users of both platforms. This is also why we see other users advising against using Revolut for saving purposes and to primarily use it as a payment account in case your account is frozen.

Why not use both apps?

Since Revolut offers a free account via its Standard Plan, it’s a good idea to give it a try and see if it meets your needs. If you find it works well for your banking and financial management requirements, you can continue using it. However, if you encounter limitations or prefer a more comprehensive solution, you can also start exploring Bunq as an alternative.

You can also test-drive Bunq’s app for free with a free trial or its free savings account. There’s also a 3-month [Revolut free trial]((https://satoshifire.com/to/revolut). As such, you could even use both for free and benefit the most. Many individuals also choose to use multiple banking apps to benefit from the unique features each offers. Ultimately, the choice is yours, and it’s possible to switch or use both apps based on your preferences and experiences. Check out Bunq and Revolut.

Get 3-Month Revolut Premium Trial