Eversend is a mobile fintech startup founded by Ugandan entrepreneur Stone Atwine. The fintech allows users to save, send and exchange money in multiple currencies in a single app. Users are also able to pay bills, send talk-time and get credit. Soon, users will be able to buy insurance as well.

We started with one inspired young man fixing the perils of sending remittances to her grandma in Uganda. Now we’re building the financial octopus for Africa and beyond.

How to Open Eversend Account

Eversend sign up process is simple and straightforward. To open an account with Eversend, you must be 18 years old or above. You can download the Eversend app from Google Play Store or IOS App store. You will be asked to enter your email, phone number and a password. Make sure the number you provide is valid, as Eversend will send you a text or give you a call to verify. After entering the 6-digit code that you received, you will be asked for your name and date of birth.

You will then see a success message, showing that your account has been created. After pressing the “Start using Eversend” button, you will be re-directed to the home page. In order to use your account, you must finish the verification process. Click on the red button, “Upload your identification.”

You need to allow Eversend to have access to your camera and SD card in order to take a photo of your ID and yourself. After taking a picture of your ID document, you then type in the details. You then take a clear photo of yourself for Eversend to check that you are the same person as pictured in your ID. Make sure the photo is clear, and every detail is readable. You will hear back from Eversend team from 10 minutes to one day. Remember that Eversend login is found on Eversend app only and not on the website.

Eversend allows access through USSD channels so that anyone with a mobile phone can access financial services. No need for Internet.

How Does Eversend Work?

How to Send Money

Login to Eversend app. If you don’t have money in your account, click the + sign to add money to your wallet. You will then be required to choose the method you would like to use to add money. It could be through mobile money or debit/credit card. After selecting the method of payment, enter the amount of money you would like to add, then click add money. For mobile money, a prompt will be sent where you will input your mobile money PIN to authorise the transaction.

To send money, go to the send feature, where you will see all your contacts who are registered on Eversend. You can also send money to yourself if you would like to withdraw your money from the app. Money can be sent in the form of mobile money, or talk-time.

Sending money to a mobile money account takes approximately 5 minutes, while sending money to a bank account takes the same day, or next day if the money was sent after 4pm.

Adding Money to Eversend by Card

- Open the Eversend app and tap ‘Add money’

- Add your correct card details including the 16-digit card number, expiry date, and CVV code

- Enter the amount you would like to add

- If successful, your top-up will appear instantly in your wallet

Adding Money to Eversend by Mobile Money

- Click ‘Add money’ for currencies where we support mobile money (Kenya, Uganda, Tanzania and Rwanda)

- Enter the amount and tap ‘Load Money’

- Eversend will send a debit request to your default registered number

- Eversend will need to verify the numbers by SMS before you can top up

- You can add more than one number for mobile money top-ups.

Unfortunately, Eversend does not accept cheques or cash deposits into your Eversend account.

How to Withdraw Money From Eversend

Eversend provides three methods for withdrawing money from their platform. First, you can withdraw funds directly to your bank account. Second, you have the option to withdraw to your mobile money wallet. Lastly, Eversend also allows withdrawals to a crypto wallet for those who prefer this method.

How to Pay Bills and Buy Talktime

You can pay bills using Eversend app. To do this, select Payment and then select the bills you would like to pay. You can also buy talk-time, by clicking on the Airtime feature and then select who you would like to buy it for. Enter the amount you would like to buy, then click continue to follow the remaining instructions.

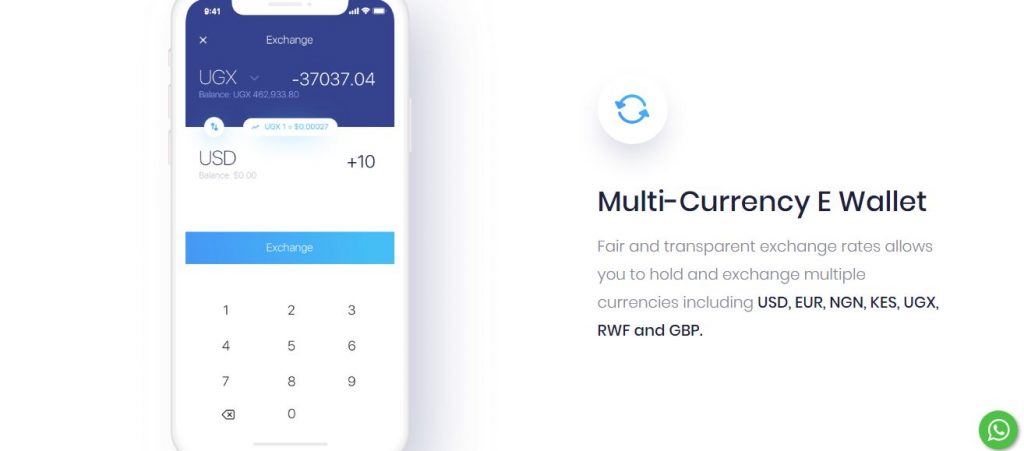

How to Exchange Currency

You can exchange between currencies in the Exchange section of the app. Enter the amount of money you would like to exchange on the top, and the amount you will receive will appear in the box below. Click ‘Exchange’, then your balance will be updated.

We are currently working to get our exchange rate as close to the interbank rate as possible.

Maximum Amount to Store

You can store up to 3000 US dollars. In case you want to store more, you need to get in touch with Eversend for them to conduct enhanced due diligence.

Maximum and Minimum Amount to Transact

The amount will depend on many factors such as the country, payment method, and delivery method. Luckily, the app will show you the amount with your chosen arrangements.

Eversend Supported Currencies and Cards

You can top up your Eversend account with a debit or credit card that operates in the following currencies UGX, TZS, GBP, EUR, USD, AUD, CAD, CHF, CZK, DKK, HKD, NOK, PLN, RON, and SEK. Supported cards are Mastercard, Visa, and Maestro cards. Note that you can create a US dollar virtual debit card and shop online instantly. You can load the card with any supported currencies and exchange the funds into US dollars.

Eversend Dollar Card

Eversend has virtual cards that are denominated in US dollars. You can use Eversend dollar card to make online payments. For instance, you can use Eversend dollar card to pay Netflix, Google, Facebook, Amazon, etc.

Eversend Dollar Rate

When you use Eversend, you can save up to 13% in fees. Virtual debit card cards offered by banks charge 15% of hidden fees for online payments. You can save on these costs by opening Eversend virtual card and start making online payments.

Eversend is one of the best currency exchange platforms in Africa. It is supported in countries such as Ghana, Kenya, Nigeria, Rwanda, South Africa, Swaziland, Tanzania, and Uganda.

For instance, you can use the Eversend dollar to naira rate when you want to convert dollars to naira. You can also use Eversend naira to dollar rate to convert naira to the dollar.

Eversend Money Transfer

Eversend supports money transfers and borderless payments. You can transfer money from Eversend wallet to wallet and have it delivered instantly or just in a few minutes. Such transfers don’t need third-party payment partners to process, and that is why they are fast.

Eversend Supported Countries

Currently, Eversend countries supported include the following:

- Africa: Ghana, Kenya, Nigeria, Rwanda, South Africa, Swaziland, Tanzania, Uganda

- Europe: Belgium, Netherlands, France, Germany, Switzerland, United Kingdom

- Rest of the World: Australia, Canada, India, Kuwait, South Korea, Turkey, United Arab Emirates, United States

Eversend Fees

Eversend says that it is working hard to bring no-cost transfers. At the moment, the cost of international money transfers on Eversend differs across countries and payment methods. The Eversend exchange rate is between 1.5–3.5%. There is also a $1 card issuing fee and a $1 monthly fee. However, sending to an Eversend wallet or sending talk-time using your Eversend wallet is free of charge.

You can check Eversend country-specific fees here.

We make sure to clearly show you the total cost in the app before you send your money — when you enter your transaction details on the app.

Eversend Alternative

There are other banking apps in Africa that offer similar functionalities. These include:

- Chipper Cash

- WayaWaya

- Kuda Bank (Nigeria)

- Bankly (Nigeria)

- ALAT (Nigeria)

More Information

Is Eversend legit?

Eversend is a legitimate FinTech company founded in 2017. It offers financial services like money transfers, currency exchange, and stock trading. Regulated by the FCA in the UK and the CBN in Nigeria, Eversend is also part of the World Bank's Global Trade Finance Program.

Does Eversend Work in Nigeria?

Yes, you can use Eversend in Nigeria.

What is Eversend virtual card limit?

There are no limits on the amount of money you can add to Eversend daily, weekly or monthly. There may be limits associated with the add money method you are using, e.g. using mobile money may have limits imposed by the mobile money operators.

How do I withdraw money from Eversend?

Eversend offers three withdrawal options: to your bank account, mobile money wallet, or a crypto wallet.