N26 is one of the most popular virtual banking services provider founded in 2013. With N26, you can open your account in less than eight minutes from your device. You can open a personal or business bank account with N26. In this review, we will take a look at the N26 Business Account option.

What is N26 Business Bank Account?

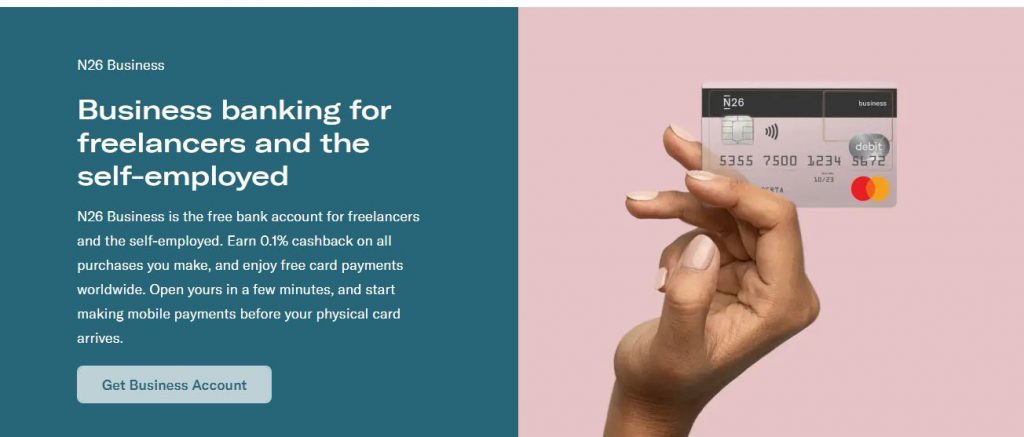

The N26 Business You bank account is designed for self-employed and freelancers ONLY who operate under their own name. That means you can’t have your company’s name on the account or card. Once you meet N26 requirements, you can choose one of the four business account options, which are N26 Business Standard bank account, N26 Business Smart account, N26 Business You account, and N26 Business Metal account.

N26 business account UK / N26 business account US: N26 left the UK market after Brexit. As a result, N26 has left the UK and closed all accounts, including N26 business accounts in the UK. Similarly, N26 bank will no longer be available in the US after January 18, 2022.

Requirements for N26 Business Account

To be eligible for N26 business account, you need to meet the following minimum requirements. Your account must be for business operating under your personal name, and you must not have a personal account with N26. You also need to be a resident of one of the supported countries. These countries include Germany, Austria, Slovakia, France, Italy, Estonia, Spain, Portugal, Luxembourg, Ireland, Greece, Belgium, the Netherlands, Finland, Lithuania, Latvia or Slovenia.

Most importantly, once your account is active, you can operate your account as you would any traditional account. You can make transfers, purchase goods and manage transactions while at the same time getting real-time notifications for your activities.

Check out N26 Business Account Website

N26 Business vs Personal

The difference between N26 business and personal account is simple. N26 personal account cannot be used for business purposes. With N26 business account, you can benefit from 0.1% cashback on purchases. Other differences include monthly charges.

Types of N26 Business Bank Account

N26 Business Standard Account

The N26 Business Standard account comes with the following features:

- The N26 Business Standard bank account is a free business bank account.

- A free debit Mastercard and virtual card to spend in stores, online or in apps.

- Easily manage all your business finances in one app.

- Free ATM withdrawals and intelligent spending analytics with Statistics.

- Free instant bank transfers with N26 MoneyBeam and SEPA Instant Credit Transfers.

N26 Business Smart Account

This is a premium business bank account. Some of its features are:

- Debit Mastercard and intelligent features to better manage your business expenses.

- Statistics for an AI-driven overview of your business expenses.

- 10 Spaces sub-accounts—including Shared Spaces to save together with others.

- Free ATM withdrawals, free payments in any currency worldwide, and access to exclusive partner offers.

N26 Business You

This is a suitable option for you as a freelancer with travel insurance from Allianz. You will enjoy all the features and benefits provided in the N26 Business Smart and N26 Business Standard. You will also enjoy the following benefits:

- You get to make up to 5 free withdrawals in the Eurozone.

- Free worldwide ATM withdrawals with your N26 business card.

- 0.1% cashback on purchases.

- Your partner and kids have the advantage of medical travel insurance in case of an emergency.

- There is the compensation of up to 10000 Euros in the event that a trip is cancelled or curtailment of a covered event.

- You can enjoy insurance packages for flight (in case of delays or cancellation) luggage (in case of loss or delay) lifestyle insurance for mobility and winter sport.

- The shared sub-accounts provide spaces to save money with friends.

N26 Business Metal

This is the premium bank service with a metal card and fantastic cashback offers. In addition to enjoying the same benefits under the other three options, N26 Business Metal comes with the following features and benefits.

- You get 0.5% cashback on the purchases you make.

- Your partner and kids have the advantage of medical travel insurance in case of an emergency.

- There is the compensation of up to 10000 Euros in the event that a trip is cancelled or curtailment of a covered event.

- You can enjoy insurance packages for flight (in case of delays or cancellation) luggage (in case of loss or delay) lifestyle insurance for mobility and winter sport.

- There is compensation for any away from home rental car hires of up to 20000 Euros.

- In the case of phone theft or damage, you have phone insurance of up to 1000 Euros.

- Dedicated N26 Metal priority line to contact the customer service directly via phone.

Also Read: Complete N26 US Review

N26 Business Account Fees

| N26 Business Account | N26 Business Pricing |

|---|---|

| N26 Business Standard | €0.00/month |

| N26 Business Smart | €4.90/month |

| N26 Business You | €9.90/month |

| N26 Business Metal | €16.90/month |

How Safe is Your Money With N26 Business Account?

Indeed, you can be confident that your money is secure with N26. The reason being, having complied with the rules of the German Financial Regulatory Authority, the organization is fully licensed by the European Central Bank. Your money is protected up to €100,000 by the German Deposit Protection Schemes.

N26 Business Review: Bank Account for Freelancers

N26 Business account is an ideal choice for you if you are a freelancer or self-employed. The account comes with 3D protected N26 MasterCard, with no additional fees. Moreover, you have good customer support team on standby to give you service and help you with any clarifications in case you are stuck. However, you can not change from N26 business to personal account. So you need to be sure which account type meets your goals.

Check out N26 Business Account Website

N26 business account vs personal account

N26 accounts are designed for self-employed individuals and freelancers operating under their personal names. Company names cannot be used for the account or card. It's essential to consider this limitation before opening the account, as switching from personal to business accounts is currently not supported. The N26 Business account comes with exclusive features not found in the N26 Personal account, including a dedicated business account number, invoicing capabilities, expense tracking, and cashback benefits.

What are N26 business account requirements?

To qualify for an N26 business account, you must fulfill the following minimum criteria. Your account should be intended for business operations conducted under your personal name, and you must not already have a personal account with N26. Additionally, you need to be a resident of one of the supported countries, which include Germany, Austria, Slovakia, France, Italy, Estonia, Spain, Portugal, Luxembourg, Ireland, Greece, Belgium, the Netherlands, Finland, Lithuania, Latvia, or Slovenia.

Can I use N26 Business for personal spending?

N26 Business is the online bank account designed for freelancers, therefore you’re expected to use it mainly for business purposes. However, you can also use it for private purposes, as long as these are in a minority compared to your business spending. You may also use it to receive payments from customers, for spendings related to your business activity such as traveling, or to pay the rent.