European Virtual Bank Account, Non Resident Accounts, US Virtual Bank Account

Wittix vs Revolut: Which One Is Good for You?

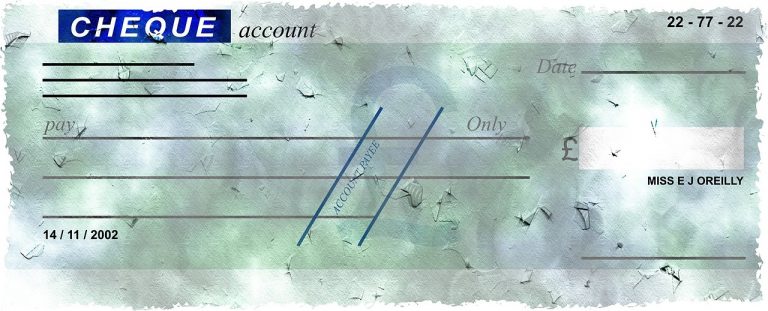

Both Wittix and Revolut are popular European challenger banks that offer a wide range of features and services. However, there are some key differences between the two platforms that may make one a better fit for you than the other. Wittix specializes in providing both personal and business borderless, multi-currency European IBAN accounts. With the …