Mistertango Bank is a European virtual bank account offering business and personal banking with an IBAN and crypto banking services.

Mistertango is currently not a banking service we would recommend. It has been receiving a lot of negative reviews. You can see them yourself in the App store, Play store as well as Trustpilot. A lot of customers have been complaining that they cannot access their money or close their accounts. Other complaints included unexpected fees and blocked payments. It only has 1.6/5 star on Trustpilot. Thankfully, there are other good Cryptobanks that offer a cheaper and far better experience, such as Revolut.

Mistertango UAB is a Lithuanian licensed fintech that offers International Bank Account Number (IBAN), virtual IBAN account, cryptocurrency services and international bank transfers as well as SEPA payments to citizens of the European Economic Area (EEA). Visit their website and read our Mistertango review below.

How to Open Mistertango Account

Mistertango has two types of accounts, Mistertango personal and Mistertango business. To open a personal account, you need to register on the website or MisterTango app, Android or iOS, by entering your email, your phone number, new password, answer a short KYC questionnaire and perform online Mistertango verification.

To open a business account, you will follow the same procedure. Once you have completed the process for opening your business account, a Mistertango team member will reach out to you to assist you with the on-boarding process. Business accounts require supporting documents for your business. For some countries, the documents must be approved by the Notary or Apostille/Legislation.

Once your account is approved, you can easily apply for physical and virtual Visa cards for payments. A Mistertango virtual card is a free, non-disposable Visa debit card that you can order and manage through your Mistertango online banking system. It’s a great option for making online purchases or payments, as it adds an extra layer of security compared to using your regular debit or credit card.

Mistertango Personal Account

Mistertango personal account customers get a European Bank IBAN number. With this number, you are able to send and receive money transfers without an extra charge for transfers to/from European Economic Area (EEA) countries, Switzerland and the UK. Making transfers is for free, and opening the account as well.

In addition, you can send and receive cryptocurrencies such as Bitcoin if you upgrade to the Red account. But in order to send and receive transfers from cryptocurrency exchanges, you need an upgrade to the Mistertango Red Crypto trading account. This account also is free to open with no monthly charges and has no limited deposit. Making transfers is not for free with the Red account, it costs 5 euro per bank transfer.

Read also: What is IBAN and IBAN Countries List 2021

Mistertango Business Account

Mistertango business account has a dedicated European bank account number. The crypto-friendly business account accepts crypto businesses such as crypto-exchanges and ICOs, forex firms and gambling industries. The account comes with an API to automate mass payments. The API allows business account holders to manage their accounts directly from their accounting system without having to log in onto Mistertango website or app. Moreover, you can create an unlimited number of virtual IBANs for each customer or payment.

The business account is also ideal for serial entrepreneurs, since you can register more than one business and manage them under one account. For cryptocurrency businesses, the business account provides access to both cryptos and fiat money. However, you need to upgrade to Business+ account at €99.99/month to support cryptocurrency/fiat money transactions.

Read also: Non-resident bank account Europe

Mistertango Bitcoin

Mistertango crypto allows its individual customers and businesses to fund cryptocurrency activities using fiat currency, bridging the gap between fiat money and cryptocurrencies such as Bitcoin. Mistertango has partnered with Nexo to offer crypto loans via a SEPA payment directly into Mistertango customer accounts.

The virtual bank also works jointly with Exmo, a cryptocurrency exchange platform, to allow its customers to fund Mistertango crypto transactions using euro.

For many crypto traders and crypto-related businesses, such as exchanges and ICO companies, a regulated current account is something that has so far been out of their reach. — Gabrielius Bilkštys, Chief Business Development Officer, Mistertango

Mistertango Fees

Mistertango Personal Account Fees

| Service | Fee |

|---|---|

| Setup fee | Free |

| Send SEPA transfers | Free |

| Receive SEPA transfers | Free |

| Minimum account balance | €10 |

| Inactivity fee (monthly) | €10 |

| Administration fee (i.e. confirmation statement, statement extract, etc.) | €50 |

| Mistertango card issuance | 0.00 Eur |

| Monthly maintenance | 0.00 Eur |

| Card renewal | 0.00 Eur |

| Virtual card account top-up | 1.5 % |

| Plastic card account top-up | 3% |

Mistertango Business Account Fees

| Service | Fee |

|---|---|

| Transfer (IN and OUT) fee | 1 Eur |

| Bank account opening fee | 200 Eur |

| Account opening for exchanges and financial institutions | 1500 Eur |

| Balance fee (monthly) | 0.10 % |

| Account maintenance fee (monthly) | 100 Eur |

| Minimum account balance | 300 Eur |

| Reassessment fee (every year) | 300 Eur |

| Card issuance | 0.00 Eur |

| Card monthly maintenance | 0.00 Eur |

| Card renewal | 0.00 Eur |

| Virtual card account top-up | 1.5 % |

| Plastic card account top-up | 3 % |

| Payments in EU/EEA | 0.00 Eur |

| Payments outside of EU/EEA | 0.00 Eur |

Set-up fee is paid 50% upfront, which is not refundable. The rest 100 Eur is paid after on-boarding is completed.

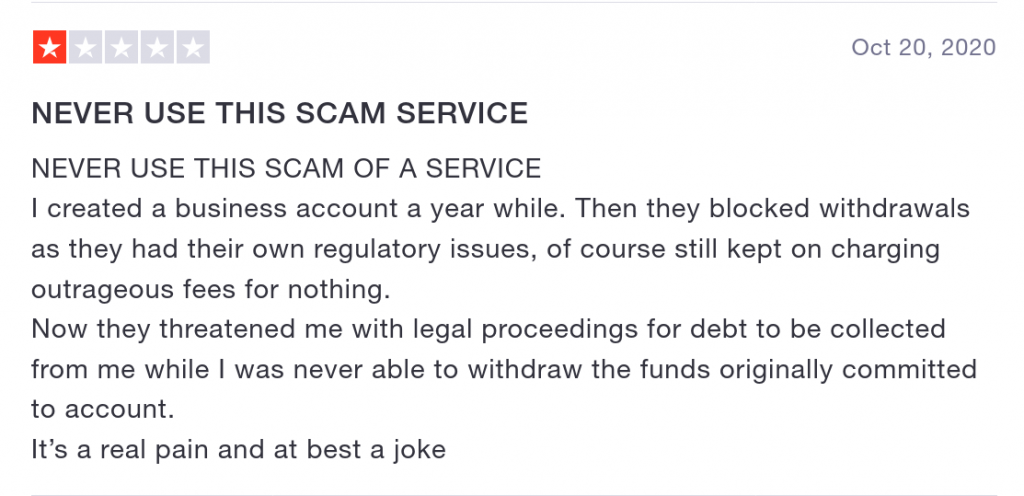

Mistertango reviews on Trustpilot show that there are Mistertango fees that are not listed on the website.

Mistertango Supported Countries, Mistertango Currencies and Mistertango Languages

Mistertango only supports clients in the European Economic Area (EEA). The bank supports SEPA and doesn’t support SWIFT. SWIFT supports international money transfers in multiple currencies, while SEPA supports payments within SEPA area in euro. Therefore, you can only send euro within EEA but not to customers outside SEPA zone. MisterTango communication is conducted in English, German, and Lithuanian.

Is Mistertango Legit and Safe?

Mistertango bank has been around since 2014. It is licensed by Electronic Money Institution (EMI) under the supervision of the Central Bank of Lithuania and registered in State Data Protection Inspectorate. Mistertango complies with the principles of data protection requirements under Law on Electronic Money and Electronic Money Institutions, Law on Legal Protection of Personal Data and General Data Protection Regulation.

Clients’ funds are stored in the Lithuanian Central Bank and other major banks in the European Union. To meet regulatory requirements, the funds are stored separately from Mistertango own funds and cannot be used for business or lending purposes.

In 2019, The Bank of Lithuania imposed a fine of €245 thousand on MisterTango, UAB for violations of anti-money laundering and counterterrorist financing (AML/CTF) requirements, limiting its activities on business accounts as a preventive measure.

The State Data Protection Inspectorate imposed an administrative fine in 2019 in the amount of EUR 61,500 for the breaches of the General Data Protection Regulation. The sanctions were imposed on MisterTango for the breaches of Articles 5, 32 and 33 of the afore-mentioned Regulation, i.e. the personal data breach in the payment initiation service system.

Mistertango is currently not a banking service we would recommend. It has been receiving a lot of negative reviews. You can see them yourself in the App store, Play store as well as Trustpilot. A lot of customers have been complaining that they cannot access their money or close their accounts. Other complaints included unexpected fees and blocked payments. It only has 1.6/5 star on Trustpilot. Thankfully, there are other good Cryptobanks that offer a cheaper and far better experience, such as Revolut.

Mistertango Alternatives

Mistertango is not the only bank that you can use to secure your crypto assets. Other crypto banks you can use are the following:

Read our review of the best crypto-friendly banks around the world

More Information About Mistertango UAB

Mistertango FAQs

Is Mistertango a bank?

Mistertango is an online bank providing private and business banking services in the EU and EEA.