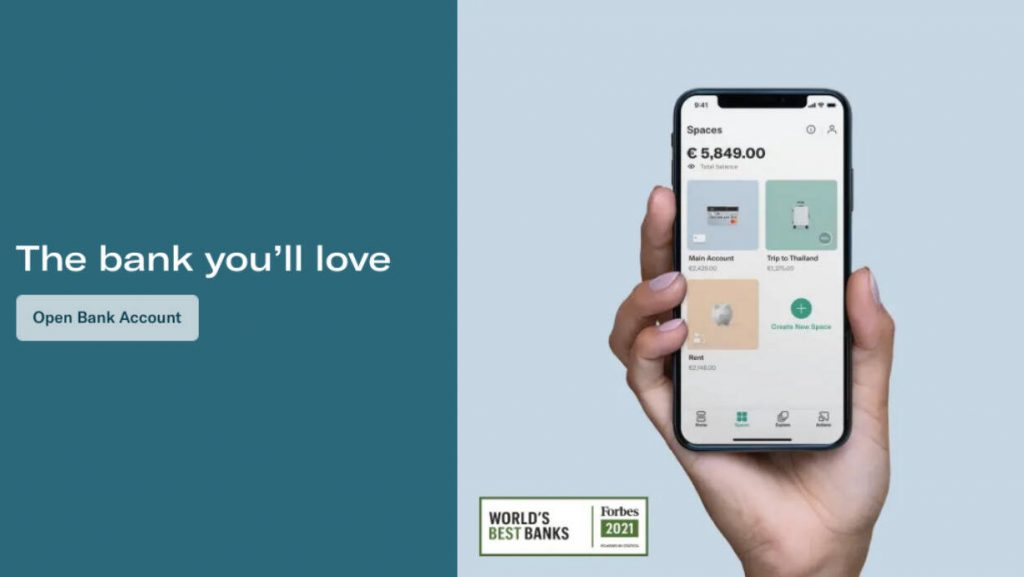

n26 Free virtual bank account

All You Need to Know About N26 Bank

N26 is a German virtual bank, which is available as a N26 Euro account from most countries in Europa. The digital bank provides a free basic current account that comes with a debit card, a free business account for freelancers, and a richly featured premium account with various add-ons such as an investment account and saving accounts, as well as extra travel insurance and gadget insurance.

N26 Virtual Account

Compare N26

N26 can be compared with other virtual account providers such as Revolut, Bunq and Monese. In the USA you can compare them with Chime, Simple and Revolut. We provide you with the details, please find them below.

Revolut Vs Monzo Vs N26

Revolut, Monzo and N26 are great online banks and fintechs that are growing in popularity. You only need to download their banking apps and sign up for a bank account. They offer personal and business IBAN, SEPA transfers, virtual cards, currency exchange, international money transfers, among other banking services. However, the three virtual banks are…

N26 vs PaySera

Virtual banks are transforming the banking sector at a high speed. With busy schedules, people are seeking to sign up with a virtual bank for easier and faster transactions. Clients seeking to sign up for an account with an online bank will consider costs, speed and the bank’s security system. Both N26 and PaySera are…

N26 vs Revolut: Which One is Better?

Both N26 and Revolut are digital banks that offer virtual bank accounts. You can open an account online and use it to spend, send, and save money. You don’t need to visit physical premises to open an account or access banking services. For a long time, we have been using the two banks and we…

N26 vs Bunq Review: Which is Better ?

Both N26 and Bunq are digital banks, meaning you can open and access your bank account via a laptop, tablet, or smartphone. You don’t need to visit a physical branch to access banking services. You can use either N26 or Bunq to save, spend, send, or hold money in different currencies. We have been vivid…

N26 US Virtual Account

N26 USA: Reviews, Products, Services

N26 launched its virtual banking services in the United States in 2019. N26 joins other new virtual banks in the US such as Chime and Simple. Unfortunately, the bank closed all N26 US accounts on January 18, 2022.

N26 Business Account

N26 Products: Business accounts

N26 has special products for freelancers and small business accounts. The basic accounts are for free and offer a wide range of services. For more features and benefits, you can upgrade to a higher service level.

N26 european virtual Account

N26 European Bank Account

The N26 virtual account offers you a standard Euro bank account from your phone, tablet or computer. The basic account is free of charge and may offer more than enough benefits as your daily bank. The N26 basic account comes with a free debit card. Extra saving plans, extra debit cards, insurance benefits and other benefits come to you with premium accounts such as N26 Smart, N26 You or N26 metal.